Oxford Nanopore Technologies (ONT) - Stock & Dividends

Exchange: London Exchange • Country: United Kingdom • Currency: GBX • Type: Common Stock • ISIN: GB00BP6S8Z30

Oxford Nanopore Technologies Ltd is a company that focuses on developing and commercializing a nanopore based sequencing platform for real-time analysis of DNA and RNA globally. With a presence in various regions including the Americas, Europe, the Middle East, Africa, India, and the Asia Pacific, the company operates in the Life Science Research Tools and Covid Testing segments.

The company offers a range of products like MinION, GridION, MinION Mk 1C, Flongle, PromethION 2 Solo, PromethION 2, PromethION 24, PromethION 48, VolTRAX, and Q-Line which cater to different sequencing needs. These products enable researchers in diverse fields such as human genetics, cancer research, outbreak surveillance, environmental analysis, pathogens/antimicrobial resistance, microbiome analysis, and crop science to conduct their scientific and biomedical research effectively.

Founded in 2005 and based in Oxford, United Kingdom, Oxford Nanopore Technologies Ltd was formerly known as Oxford NanoLabs Limited before changing its name in May 2008. To learn more about the company and its products, visit their official website at https://nanoporetech.com.

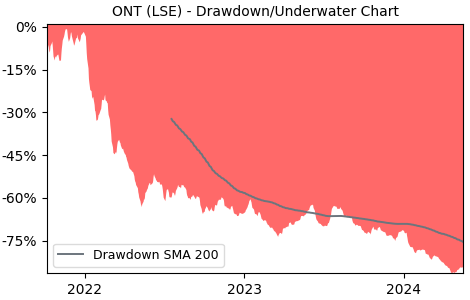

Drawdown (Underwater) Chart

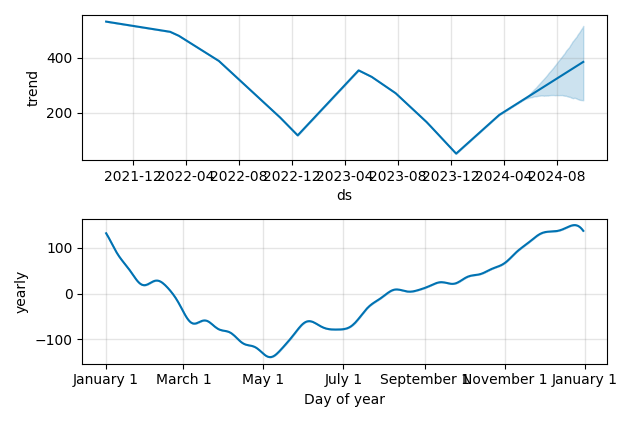

Overall Trend and Yearly Seasonality

ONT Stock Overview

| Market Cap in USD | 12m |

| Sector | Healthcare |

| Industry | Biotechnology |

| GiC SubIndustry | Biotechnology |

| TER | 0.00% |

| IPO / Inception |

ONT Stock Ratings

| Growth 5y | -6.25 |

| Fundamental | -70.0 |

| Dividend | - |

| Rel. Performance vs Sector | -8.40 |

| Analysts | - |

| Fair Price Momentum | 64.60 GBX |

| Fair Price DCF | - |

ONT Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

ONT Growth Ratios

| Growth 12m | -58.16% |

| Growth Correlation 12m | -77% |

| Growth Correlation 3m | -80% |

| CAGR 5y | -51.05% |

| Sharpe Ratio 12m | -1.24 |

| Alpha vs SP500 12m | -79.55 |

| Beta vs SP500 5y weekly | 0.86 |

| ValueRay RSI | 33.23 |

| Volatility GJR Garch 1y | 58.19% |

| Price / SMA 50 | -22.6% |

| Price / SMA 200 | -47.77% |

| Current Volume | 737.5k |

| Average Volume 20d | 1516.3k |

External Links for ONT Stock

As of April 27, 2024, the stock is trading at GBX 96.90 with a total of 737,506 shares traded.

Over the past week, the price has changed by +4.47%, over one month by -22.04%, over three months by -32.94% and over the past year by -56.35%.

According to ValueRays Forecast Model, ONT Oxford Nanopore Technologies will be worth about 71.7 in April 2025. The stock is currently trading at 96.90. This means that the stock has a potential downside of -25.96%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 221.1 | 128 |

| Analysts Target Price | - | - |

| ValueRay Target Price | 71.7 | -26.0 |