Crexendo (CXDO) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US2265521078

Crexendo, Inc. provides cloud communication platform and services, video collaboration, and managed IT services for businesses in the United States and internationally. It operates through two segments, Cloud Telecommunications Services and Software Solutions. The Cloud Telecommunications segment provides telecommunications services that transmit calls using Internet protocol (IP) or cloud technology, which converts voice signals into digital data packets for transmission over the Internet or cloud; and broadband Internet services, as well as develops end user portals for account and license management, and billing and customer support. This segment is also involved in the sale and lease of cloud telecommunications equipment. In addition, it offers hardware, software, and unified communication solutions for businesses using IP or cloud technology over high-speed internet connection through various devices and user interfaces, such as desktop phones and/or mobile, and desktop applications under the Crexendo brand name. The Software Solutions segment provides a suite of unified communications, collaboration, video conferencing, and contact center solutions. This segment also offers SNAPsolution, an IP-based platform; SNAPaccel, a software-as-a-service based software; subscription maintenance and support services; and professional services, including consulting, technical support, resident engineer, design, and installation services. The company was formerly known as iMergent, Inc. and changed its name to Crexendo, Inc. in May 2011. Crexendo, Inc. was incorporated in 1995 and is based in Tempe, Arizona. Web URL: https://www.crexendo.com

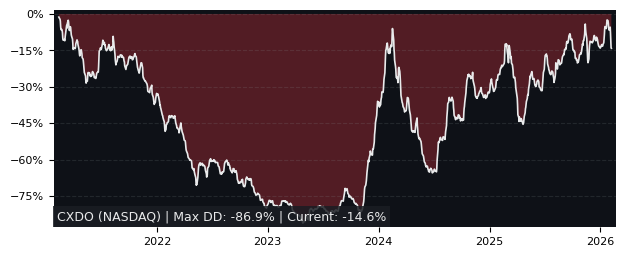

Drawdown (Underwater) Chart

CXDO Stock Overview

| Market Cap in USD | 120m |

| Sector | Communication Services |

| Industry | Telecom Services |

| GiC SubIndustry | Internet Services & Infrastructure |

| TER | 0.00% |

| IPO / Inception | 1998-06-29 |

CXDO Stock Ratings

| Growth 5y | 0.21 |

| Fundamental | 11.4 |

| Dividend | 1.38 |

| Rel. Performance vs Sector | 7.26 |

| Analysts | 4.33/5 |

| Fair Price Momentum | 5.27 USD |

| Fair Price DCF | 3.41 USD |

CXDO Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 27.2% |

CXDO Growth Ratios

| Growth 12m | 163.58% |

| Growth Correlation 12m | 59% |

| Growth Correlation 3m | -74% |

| CAGR 5y | 3.75% |

| CAGR/Mean DD 5y | 0.08 |

| Sharpe Ratio 12m | 1.84 |

| Alpha vs SP500 12m | 130.51 |

| Beta vs SP500 5y weekly | 1.15 |

| ValueRay RSI | 14.60 |

| Volatility GJR Garch 1y | 99.70% |

| Price / SMA 50 | -15.32% |

| Price / SMA 200 | 9.04% |

| Current Volume | 88.6k |

| Average Volume 20d | 111.9k |

External Links for CXDO Stock

News

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

What is the price of CXDO stocks?

As of May 15, 2024, the stock is trading at USD 3.98 with a total of 88,623 shares traded.

Over the past week, the price has changed by -14.41%, over one month by -9.55%, over three months by -37.22% and over the past year by +199.25%.

As of May 15, 2024, the stock is trading at USD 3.98 with a total of 88,623 shares traded.

Over the past week, the price has changed by -14.41%, over one month by -9.55%, over three months by -37.22% and over the past year by +199.25%.

What is the forecast for CXDO stock price target?

According to ValueRays Forecast Model, CXDO Crexendo will be worth about 5.9 in May 2025. The stock is currently trading at 3.98. This means that the stock has a potential upside of +47.99%.

According to ValueRays Forecast Model, CXDO Crexendo will be worth about 5.9 in May 2025. The stock is currently trading at 3.98. This means that the stock has a potential upside of +47.99%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 6.7 | 68.1 |

| Analysts Target Price | 4.3 | 6.78 |

| ValueRay Target Price | 5.9 | 48.0 |