Denali Therapeutics (DNLI) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US24823R1059

Denali Therapeutics Inc. is a biopharmaceutical company that develops innovative treatments for neurodegenerative diseases and lysosomal storage diseases. Their mission is to create life-changing medicines that can effectively cross the blood-brain barrier, a significant challenge in treating brain-related disorders.

The company's pipeline includes several promising programs, such as DNL310 ETV, an enzyme replacement therapy for Mucopolysaccharidosis II (MPS II), a rare genetic disorder. They are also working on TAK-594/DNL593, a potential treatment for frontotemporal dementia-granulin, a devastating brain disorder that affects behavior, language, and movement.

In addition, Denali Therapeutics is developing DNL126 for Mucopolysaccharidosis IIIA (MPS IIIA), a severe genetic disorder that affects children, and DNL622 for Mucopolysaccharidosis I (MPS I), also known as Hurler syndrome. These programs utilize the company's proprietary Transport Vehicle (TV) technology, which enables the delivery of large molecules across the blood-brain barrier.

Denali Therapeutics also has a range of small molecule programs, including BIIB122/DNL151, a LRRK2 inhibitor for Parkinson's disease, and SAR443820/DNL788, a RIPK1 inhibitor for central nervous system (CNS) diseases. They are also working on DNL343, an eIF2B activator for amyotrophic lateral sclerosis (ALS), and SAR443122/DNL758, a RIPK1 inhibitor for peripheral inflammatory diseases.

The company has established collaborations with leading biotech and pharmaceutical companies, including Biogen, Genzyme, Takeda, F-star, and Genentech. These partnerships enable Denali Therapeutics to accelerate the development of their innovative treatments and bring them to patients faster.

Founded in 2013, Denali Therapeutics is headquartered in South San Francisco, California, and has undergone significant growth and transformation, including a name change from SPR Pharma Inc. in 2015. Today, the company is a leader in the development of novel therapies for brain-related disorders, with a strong focus on innovation, collaboration, and patient-centricity.

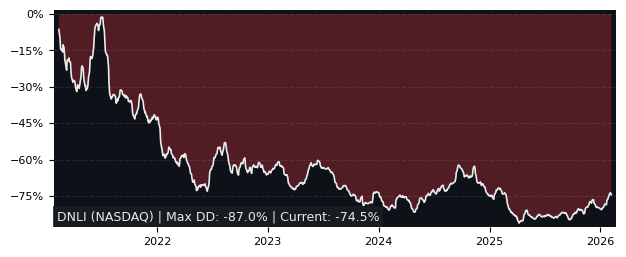

Drawdown (Underwater) Chart

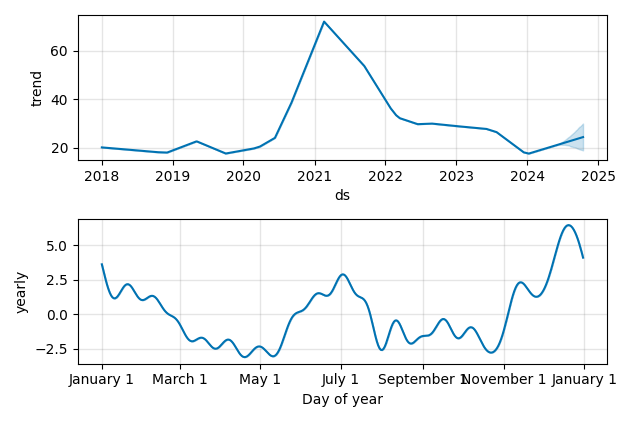

Overall Trend and Yearly Seasonality

DNLI Stock Overview

| Market Cap in USD | 2,442m |

| Sector | Healthcare |

| Industry | Biotechnology |

| GiC SubIndustry | Biotechnology |

| TER | 0.00% |

| IPO / Inception | 2017-12-08 |

DNLI Stock Ratings

| Growth 5y | -1.47 |

| Fundamental | -60.4 |

| Dividend | - |

| Rel. Performance vs Sector | -4.41 |

| Analysts | 4.53/5 |

| Fair Price Momentum | 17.68 USD |

| Fair Price DCF | - |

DNLI Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 0.0% |

DNLI Growth Ratios

| Growth 12m | -29.86% |

| Growth Correlation 12m | -65% |

| Growth Correlation 3m | -31% |

| CAGR 5y | 0.25% |

| CAGR/Mean DD 5y | 0.01 |

| Sharpe Ratio 12m | -0.51 |

| Alpha vs SP500 12m | -70.73 |

| Beta vs SP500 5y weekly | 1.47 |

| ValueRay RSI | 94.80 |

| Volatility GJR Garch 1y | 61.26% |

| Price / SMA 50 | 11.61% |

| Price / SMA 200 | 4.35% |

| Current Volume | 1401.4k |

| Average Volume 20d | 1215.1k |

External Links for DNLI Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 16, 2024, the stock is trading at USD 20.86 with a total of 1,401,423 shares traded.

Over the past week, the price has changed by +10.37%, over one month by +16.93%, over three months by +13.62% and over the past year by -34.85%.

According to ValueRays Forecast Model, DNLI Denali Therapeutics will be worth about 19.9 in May 2025. The stock is currently trading at 20.86. This means that the stock has a potential downside of -4.55%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 41.2 | 97.5 |

| Analysts Target Price | 55.6 | 167 |

| ValueRay Target Price | 19.9 | -4.55 |