Oaktree Specialty Lending (OCSL) - Stock & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US67401P1084

Debt Investments, Loans, Equity

Oaktree Specialty Lending Corporation is a business development company that specializes in providing customized financing solutions to small and mid-sized companies.

Their investment portfolio is diversified across various industries, including education services, business services, retail and consumer, healthcare, manufacturing, food and restaurants, construction and engineering, as well as media, advertising, software, IT services, pharmaceuticals, biotechnology, real estate management and development, chemicals, machinery, and internet and direct marketing retail sectors.

Oaktree Specialty Lending Corporation offers a range of financing options, including bridge financing, first and second lien debt financing, unsecured and mezzanine loans, mezzanine debt, senior and junior secured debt, expansions, sponsor-led acquisitions, preferred equity, and management buyouts.

Their investment size typically ranges from $5 million to $75 million, and they may also include an equity co-investment component in companies. They focus on companies with an enterprise value between $20 million and $150 million and EBITDA between $3 million and $50 million.

Oaktree Specialty Lending Corporation has a hold size of up to $75 million and may underwrite transactions up to $100 million. They primarily operate in North America and aim to be a lead investor in their portfolio companies.

For more information, you can visit their website at https://www.oaktreespecialtylending.com.

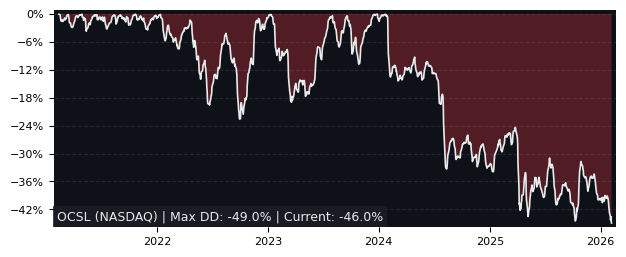

Drawdown (Underwater) Chart

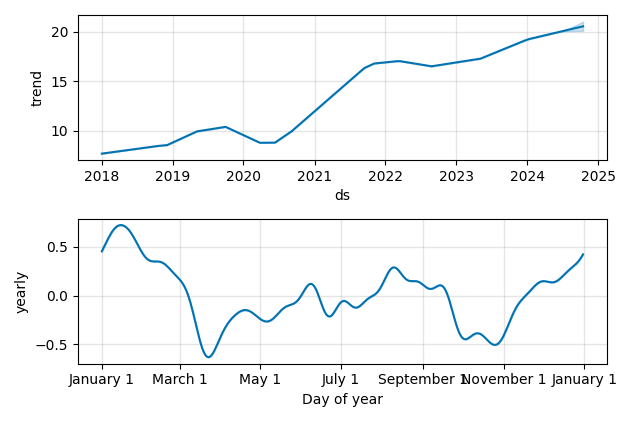

Overall Trend and Yearly Seasonality

OCSL Stock Overview

| Market Cap in USD | 1,513m |

| Sector | Financial Services |

| Industry | Credit Services |

| GiC SubIndustry | Asset Management & Custody Banks |

| TER | 0.00% |

| IPO / Inception | 2008-06-12 |

OCSL Stock Ratings

| Growth 5y | 7.98 |

| Fundamental | 15.7 |

| Dividend | 9.55 |

| Rel. Performance vs Sector | -1.24 |

| Analysts | 4.00/5 |

| Fair Price Momentum | 19.39 USD |

| Fair Price DCF | 120.34 USD |

OCSL Dividends

| Yield 12m | 11.78% |

| Yield on Cost 5y | 21.52% |

| Dividends CAGR 5y | 15.24% |

| Payout Consistency | 90.9% |

OCSL Growth Ratios

| Growth 12m | 16.71% |

| Growth Correlation 12m | 61% |

| Growth Correlation 3m | 9% |

| CAGR 5y | 12.80% |

| CAGR/Mean DD 5y | 2.10 |

| Sharpe Ratio 12m | 0.72 |

| Alpha vs SP500 12m | -16.65 |

| Beta vs SP500 5y weekly | 1.16 |

| ValueRay RSI | 27.09 |

| Volatility GJR Garch 1y | 19.13% |

| Price / SMA 50 | -0.67% |

| Price / SMA 200 | 0.73% |

| Current Volume | 591.3k |

| Average Volume 20d | 548.7k |

External Links for OCSL Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 16, 2024, the stock is trading at USD 19.24 with a total of 591,322 shares traded.

Over the past week, the price has changed by +0.58%, over one month by +0.05%, over three months by -1.48% and over the past year by +16.84%.

According to ValueRays Forecast Model, OCSL Oaktree Specialty Lending will be worth about 21.1 in May 2025. The stock is currently trading at 19.24. This means that the stock has a potential upside of +9.46%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 20.6 | 7.28 |

| Analysts Target Price | 21.5 | 11.7 |

| ValueRay Target Price | 21.1 | 9.46 |