Buckle (BKE) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US1184401065

The Buckle, Inc. is a leading retailer of casual apparel, footwear, and accessories for young men and women in the United States. With a wide range of brand name products, including denim, tops, sportswear, outerwear, and accessories, the company offers a unique shopping experience for its customers.

In addition to its brand name products, The Buckle, Inc. also offers a variety of private label merchandise, including BKE, Buckle Black, Salvage, Red by BKE, and many others. This allows customers to find high-quality products at affordable prices, making it a one-stop shop for all their fashion needs.

The company goes beyond just selling products by offering a range of services to enhance the shopping experience. These services include hemming, gift-packaging, layaways, a guest loyalty program, and a private label credit card. Additionally, customers can take advantage of personalized stylist services and a special order system that allows them to request merchandise from other company stores or its online order fulfillment center.

In addition to its physical stores, The Buckle, Inc. also sells its products through its website, buckle.com. This allows customers to shop from the comfort of their own homes and have products shipped directly to their doorstep. With a strong online presence, the company is able to reach a wider customer base and stay competitive in the retail industry.

With a rich history dating back to 1948, The Buckle, Inc. has evolved over the years to become a leading retailer in the fashion industry. Formerly known as Mills Clothing, Inc., the company changed its name to The Buckle, Inc. in April 1991. Today, it is headquartered in Kearney, Nebraska, and continues to provide high-quality products and services to its customers.

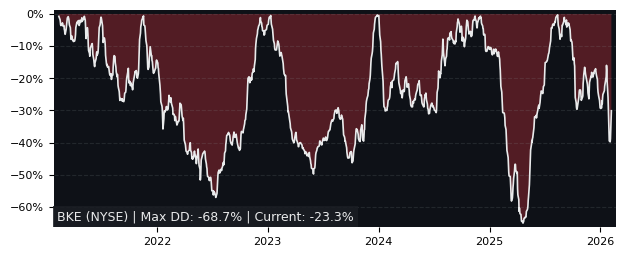

Drawdown (Underwater) Chart

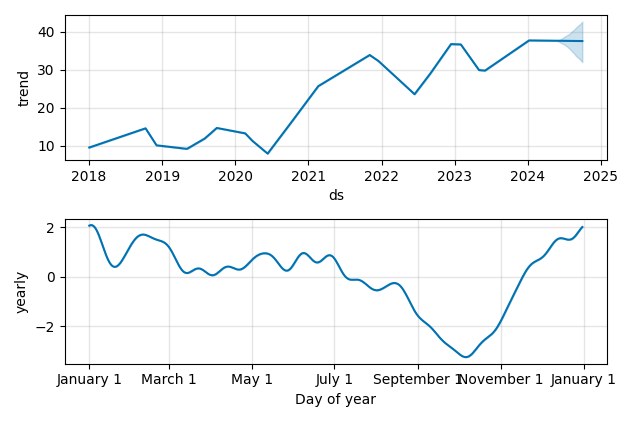

Overall Trend and Yearly Seasonality

BKE Stock Overview

| Market Cap in USD | 1,863m |

| Sector | Consumer Cyclical |

| Industry | Apparel Retail |

| GiC SubIndustry | Apparel Retail |

| TER | 0.00% |

| IPO / Inception | 1992-05-06 |

BKE Stock Ratings

| Growth 5y | 7.65 |

| Fundamental | 67.2 |

| Dividend | 8.20 |

| Rel. Performance vs Sector | 0.53 |

| Analysts | 2.00/5 |

| Fair Price Momentum | 40.45 USD |

| Fair Price DCF | 119.70 USD |

BKE Dividends

| Yield 12m | 10.38% |

| Yield on Cost 5y | 37.00% |

| Dividends CAGR 5y | 15.16% |

| Payout Consistency | 63.9% |

BKE Growth Ratios

| Growth 12m | 24.05% |

| Growth Correlation 12m | 54% |

| Growth Correlation 3m | -28% |

| CAGR 5y | 28.89% |

| CAGR/Mean DD 5y | 1.66 |

| Sharpe Ratio 12m | 0.61 |

| Alpha vs SP500 12m | -4.25 |

| Beta vs SP500 5y weekly | 0.95 |

| ValueRay RSI | 35.98 |

| Volatility GJR Garch 1y | 33.12% |

| Price / SMA 50 | -0.95% |

| Price / SMA 200 | 4.42% |

| Current Volume | 377.7k |

| Average Volume 20d | 290.3k |

External Links for BKE Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 16, 2024, the stock is trading at USD 37.56 with a total of 377,660 shares traded.

Over the past week, the price has changed by -2.82%, over one month by +2.82%, over three months by -5.16% and over the past year by +24.31%.

According to ValueRays Forecast Model, BKE Buckle will be worth about 44.6 in May 2025. The stock is currently trading at 37.56. This means that the stock has a potential upside of +18.69%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 34 | -9.48 |

| Analysts Target Price | 38 | 1.17 |

| ValueRay Target Price | 44.6 | 18.7 |