Deluxe (DLX) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US2480191012

Deluxe Corporation is a leading provider of innovative solutions for businesses, financial institutions, and enterprises across the United States, Canada, and Australia.

The company operates through four main segments: Merchant Services, B2B Payments, Data Solutions, and Print. The Merchant Services segment focuses on providing credit and debit card authorization and payment systems, as well as processing services, primarily to small and medium-sized retail and service businesses.

The B2B Payments segment offers a range of treasury management solutions, including remittance and lockbox processing, remote deposit capture, automated receivables management, payment processing, and cash application. Additionally, it provides automated payables management services, such as medical payment and deluxe payment exchange, to help businesses streamline their financial operations.

The Data Solutions segment is dedicated to providing data-driven marketing solutions, financial institution profitability reporting, and business incorporation services. This segment helps businesses make informed decisions and stay ahead in the competitive market.

The Print segment is responsible for producing high-quality printed products, including personal and business checks, business forms, business accessories, and promotional products. Deluxe Corporation sells its products and services through a multi-channel sales and marketing approach, as well as scalable partnerships.

With a rich history dating back to 1915, Deluxe Corporation has evolved significantly since its inception as Deluxe Check Printers, Incorporated. The company changed its name to Deluxe Corporation in 1988 and is currently headquartered in Minneapolis, Minnesota. For more information, visit their website at https://www.deluxe.com.

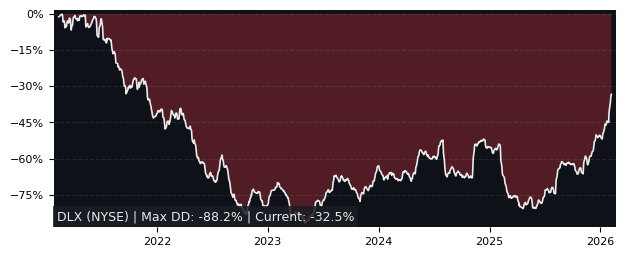

Drawdown (Underwater) Chart

DLX Stock Overview

| Market Cap in USD | 876m |

| Sector | Communication Services |

| Industry | Advertising Agencies |

| GiC SubIndustry | Commercial Printing |

| TER | 0.00% |

| IPO / Inception | 1987-07-23 |

DLX Stock Ratings

| Growth 5y | -1.40 |

| Fundamental | 1.82 |

| Dividend | 6.42 |

| Rel. Performance vs Sector | 2.60 |

| Analysts | 4.33/5 |

| Fair Price Momentum | 26.70 USD |

| Fair Price DCF | 62.05 USD |

DLX Dividends

| Yield 12m | 5.16% |

| Yield on Cost 5y | 3.80% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 97.0% |

DLX Growth Ratios

| Growth 12m | 62.45% |

| Growth Correlation 12m | 54% |

| Growth Correlation 3m | 40% |

| CAGR 5y | -5.91% |

| CAGR/Mean DD 5y | -0.15 |

| Sharpe Ratio 12m | 1.55 |

| Alpha vs SP500 12m | 29.74 |

| Beta vs SP500 5y weekly | 1.13 |

| ValueRay RSI | 93.45 |

| Volatility GJR Garch 1y | 34.16% |

| Price / SMA 50 | 14.53% |

| Price / SMA 200 | 20.65% |

| Current Volume | 304k |

| Average Volume 20d | 244.6k |

External Links for DLX Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 16, 2024, the stock is trading at USD 23.25 with a total of 303,971 shares traded.

Over the past week, the price has changed by +4.92%, over one month by +21.79%, over three months by +13.36% and over the past year by +68.52%.

According to ValueRays Forecast Model, DLX Deluxe will be worth about 28.8 in May 2025. The stock is currently trading at 23.25. This means that the stock has a potential upside of +24.04%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 29.3 | 25.8 |

| Analysts Target Price | 28.3 | 21.8 |

| ValueRay Target Price | 28.8 | 24.0 |