Hanesbrands (HBI) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US4103451021

Hanesbrands Inc. is a leading consumer goods company that specializes in designing, manufacturing, and selling a wide range of innerwear apparel for men, women, and children. With a global presence, the company operates in the Americas, Europe, Asia Pacific, and other international markets.

The company's product portfolio is divided into three main segments: Innerwear, Activewear, and International. Under Innerwear, Hanesbrands offers a variety of products, including men's underwear, women's panties, children's underwear, and socks. The company also offers intimate apparel, such as bras and shapewear, as well as home goods.

In the Activewear segment, Hanesbrands sells a range of apparel, including T-shirts, fleece, performance apparel, sport shirts, and thermals. The company also offers licensed logo apparel in collegiate bookstores and mass retail channels. Additionally, Hanesbrands licenses its Champion brand name for footwear and sports accessories.

Hanesbrands sells its products under a diverse range of brand names, including Hanes, Champion, Maidenform, JMS/Just My Size, Bali, Polo Ralph Lauren, Playtex, Alternative, Gear for Sports, Comfortwash, Hanes Beefy-T, Bonds, Sheridan, Bras N Things, Wonderbra, Berlei, Zorba, Sol y Oro, Maidenform, Rinbros, Bellinda, and RITMO. The company distributes its products through retailers, wholesalers, and third-party embellishers.

Founded in 1901, Hanesbrands Inc. is headquartered in Winston-Salem, North Carolina. With a rich history spanning over a century, the company has established itself as a leading player in the consumer goods industry. For more information, visit their website at https://www.hanes.com.

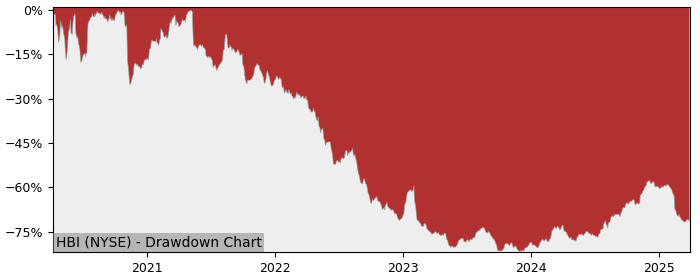

Drawdown (Underwater) Chart

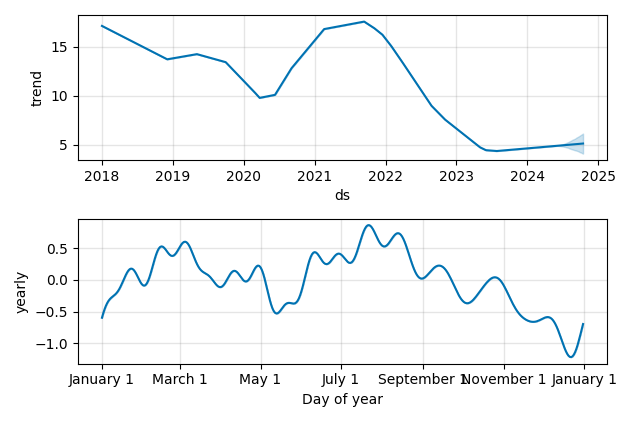

Overall Trend and Yearly Seasonality

HBI Stock Overview

| Market Cap in USD | 1,642m |

| Sector | Consumer Cyclical |

| Industry | Apparel Manufacturing |

| GiC SubIndustry | Apparel, Accessories & Luxury Goods |

| TER | 0.00% |

| IPO / Inception | 2006-09-06 |

HBI Stock Ratings

| Growth 5y | -3.98 |

| Fundamental | -5.85 |

| Dividend | 2.01 |

| Rel. Performance vs Sector | 0.18 |

| Analysts | 2.88/5 |

| Fair Price Momentum | 4.60 USD |

| Fair Price DCF | 41.18 USD |

HBI Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | -100.00% |

| Payout Consistency | 73.8% |

HBI Growth Ratios

| Growth 12m | 19.57% |

| Growth Correlation 12m | 12% |

| Growth Correlation 3m | -31% |

| CAGR 5y | -18.86% |

| CAGR/Mean DD 5y | -0.48 |

| Sharpe Ratio 12m | 0.26 |

| Alpha vs SP500 12m | -5.15 |

| Beta vs SP500 5y weekly | 0.81 |

| ValueRay RSI | 76.52 |

| Volatility GJR Garch 1y | 43.43% |

| Price / SMA 50 | -1.59% |

| Price / SMA 200 | 7.84% |

| Current Volume | 4725.3k |

| Average Volume 20d | 6341.9k |

External Links for HBI Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 17, 2024, the stock is trading at USD 4.95 with a total of 4,725,258 shares traded.

Over the past week, the price has changed by +10.99%, over one month by +5.54%, over three months by +14.06% and over the past year by +21.92%.

According to ValueRays Forecast Model, HBI Hanesbrands will be worth about 5.1 in May 2025. The stock is currently trading at 4.95. This means that the stock has a potential upside of +3.03%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 4.2 | -15.4 |

| Analysts Target Price | 4.7 | -5.25 |

| ValueRay Target Price | 5.1 | 3.03 |