Oil States International (OIS) - Stock & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US6780261052

Oil States International, Inc. is a global provider of engineered capital equipment and products, serving the energy, industrial, and military sectors. The company operates through three main segments: Well Site Services, Downhole Technologies, and Offshore/Manufactured Products.

The Well Site Services segment offers a comprehensive range of equipment and services that support the entire lifecycle of an oil or gas well, from drilling to production. This includes wireline support, frac stacks, isolation tools, downhole and extended reach activity, well testing and flowback operations, sand control, and land drilling services. This segment provides critical solutions for oil and gas operators to optimize their well operations.

The Downhole Technologies segment specializes in oil and gas perforation systems and downhole tools, supporting completion, intervention, wireline, and well abandonment operations. The segment designs, manufactures, and markets consumable engineered products to oilfield service, and exploration and production companies. These products enable efficient and safe drilling and completion operations.

The Offshore/Manufactured Products segment designs, manufactures, and markets capital equipment used on floating production systems, subsea pipeline infrastructure, and offshore drilling rigs and vessels. The segment's product portfolio includes flexible bearings, advanced connector systems, high-pressure riser systems, managed pressure drilling systems, deepwater mooring systems, cranes, subsea pipeline products, and blow-out preventer stack integration products. Additionally, the segment offers short-cycle products, such as valves, elastomers, and other specialty products, for use in land-based drilling and completion markets, as well as industrial, military, alternative energy, and other applications.

The company also provides a range of services, including specialty welding, fabrication, cladding, and machining, offshore installation, and inspection and repair services. With a strong focus on innovation and customer satisfaction, Oil States International, Inc. has established itself as a leading provider of engineered capital equipment and products. Headquartered in Houston, Texas, the company was incorporated in 1995 and continues to serve its global customer base.

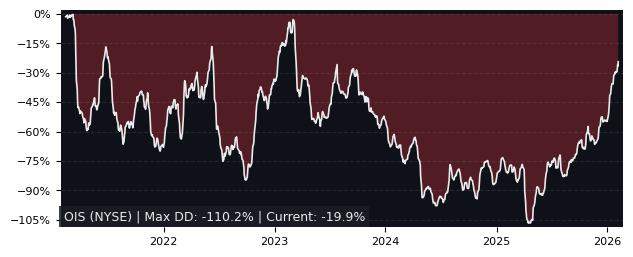

Drawdown (Underwater) Chart

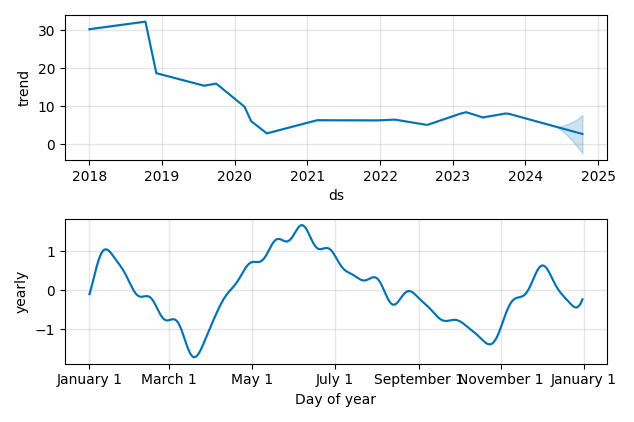

Overall Trend and Yearly Seasonality

OIS Stock Overview

| Market Cap in USD | 284m |

| Sector | Energy |

| Industry | Oil & Gas Equipment & Services |

| GiC SubIndustry | Oil & Gas Equipment & Services |

| TER | 0.00% |

| IPO / Inception | 2001-02-09 |

OIS Stock Ratings

| Growth 5y | -3.70 |

| Fundamental | 15.9 |

| Dividend | 0.05 |

| Rel. Performance vs Sector | -5.94 |

| Analysts | 3.80/5 |

| Fair Price Momentum | 3.99 USD |

| Fair Price DCF | 7.38 USD |

OIS Dividends

| Yield 12m | 0.00% |

| Yield on Cost 5y | 0.00% |

| Dividends CAGR 5y | 0.00% |

| Payout Consistency | 1.0% |

OIS Growth Ratios

| Growth 12m | -32.21% |

| Growth Correlation 12m | -58% |

| Growth Correlation 3m | -27% |

| CAGR 5y | -24.66% |

| CAGR/Mean DD 5y | -0.40 |

| Sharpe Ratio 12m | -0.76 |

| Alpha vs SP500 12m | -79.20 |

| Beta vs SP500 5y weekly | 1.72 |

| ValueRay RSI | 42.07 |

| Volatility GJR Garch 1y | 83.64% |

| Price / SMA 50 | -15.41% |

| Price / SMA 200 | -31.19% |

| Current Volume | 1388.1k |

| Average Volume 20d | 1737.4k |

External Links for OIS Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of May 16, 2024, the stock is trading at USD 4.61 with a total of 1,388,082 shares traded.

Over the past week, the price has changed by +4.30%, over one month by -21.06%, over three months by -25.40% and over the past year by -32.50%.

According to ValueRays Forecast Model, OIS Oil States International will be worth about 4.4 in May 2025. The stock is currently trading at 4.61. This means that the stock has a potential downside of -4.12%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 7.4 | 60.5 |

| Analysts Target Price | 9.9 | 115 |

| ValueRay Target Price | 4.4 | -4.12 |