Vertiv Holdings Co (VRT) - Stock Price & Dividends

Exchange: USA Stocks • Country: United States • Currency: USD • Type: Common Stock • ISIN: US92537N1081

Vertiv Holdings Co, through its subsidiaries, creates, manufactures, and maintains essential digital infrastructure technologies and services for a range of sectors worldwide. The company operates in the Americas, Asia Pacific, Europe, the Middle East, and Africa.

Vertiv designs and provides a variety of products including AC and DC power management systems, switchgear, thermal management solutions, modular racks, and monitoring systems. These technologies are pivotal in supporting key services such as e-commerce, online banking, video streaming, wireless communication, and IoT applications.

In addition to products, Vertiv offers lifecycle management services, predictive analytics, and professional support for implementing and optimizing their solutions. Services include maintenance, testing, engineering, consulting, monitoring, training, and digital infrastructure software.

The company's product portfolio is known under brands like Vertiv, Liebert, NetSure, and Geist. Vertiv serves a wide range of industries such as social media, finance, healthcare, transportation, education, and government sectors using direct sales teams, independent representatives, channel partners, and OEMs.

Vertiv Holdings Co is located in Westerville, Ohio, and more information about their offerings can be found on their website at https://www.vertiv.com.

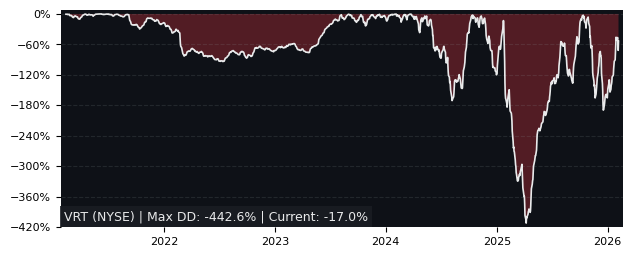

Drawdown (Underwater) Chart

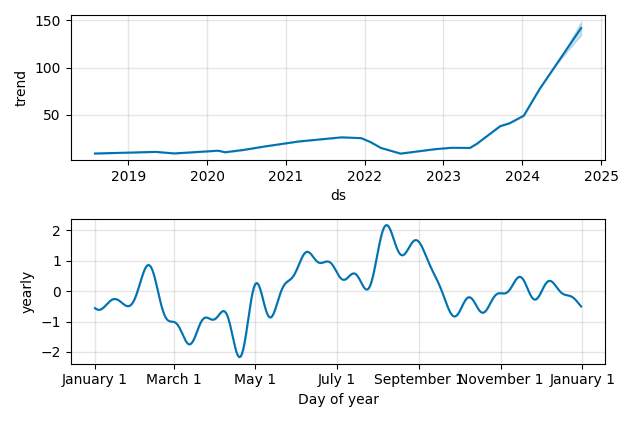

Overall Trend and Yearly Seasonality

VRT Stock Overview

| Market Cap in USD | 28,652m |

| Sector | Industrials |

| Industry | Electrical Equipment & Parts |

| GiC SubIndustry | Electrical Components & Equipment |

| TER | 0.00% |

| IPO / Inception | 2018-07-30 |

VRT Stock Ratings

| Growth 5y | 8.39 |

| Fundamental | 73.0 |

| Dividend | 6.52 |

| Rel. Performance vs Sector | 16.53 |

| Analysts | 4.62/5 |

| Fair Price Momentum | 192.12 USD |

| Fair Price DCF | 49.62 USD |

VRT Dividends

| Yield 12m | 0.05% |

| Yield on Cost 5y | 0.50% |

| Dividends CAGR 5y | 25.74% |

| Payout Consistency | 98.8% |

VRT Growth Ratios

| Growth 12m | 527.17% |

| Growth Correlation 12m | 92% |

| Growth Correlation 3m | 77% |

| CAGR 5y | 55.92% |

| Sharpe Ratio 12m | 9.71 |

| Alpha vs SP500 12m | 493.85 |

| Beta vs SP500 5y weekly | 1.50 |

| ValueRay RSI | 89.86 |

| Volatility GJR Garch 1y | 58.55% |

| Price / SMA 50 | 22.8% |

| Price / SMA 200 | 85.64% |

| Current Volume | 14690.2k |

| Average Volume 20d | 10345.3k |

External Links for VRT Stock

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

As of April 27, 2024, the stock is trading at USD 93.49 with a total of 14,690,200 shares traded.

Over the past week, the price has changed by +24.64%, over one month by +13.09%, over three months by +74.94% and over the past year by +588.55%.

According to ValueRays Forecast Model, VRT Vertiv Holdings Co will be worth about 215.7 in April 2025. The stock is currently trading at 93.49. This means that the stock has a potential upside of +130.73%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | 87.7 | -6.19 |

| Analysts Target Price | 43.1 | -53.9 |

| ValueRay Target Price | 215.7 | 131 |