Invesco Senior Income Trust (VVR) - Stock & Dividends

Exchange: USA Stocks • Country: USA • Currency: USD • Type: Fund • ISIN: US46131H1077 • Bank Loan

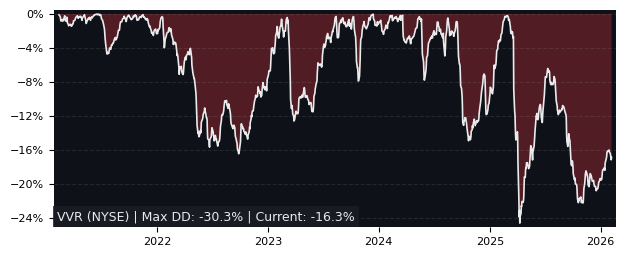

Drawdown (Underwater) Chart

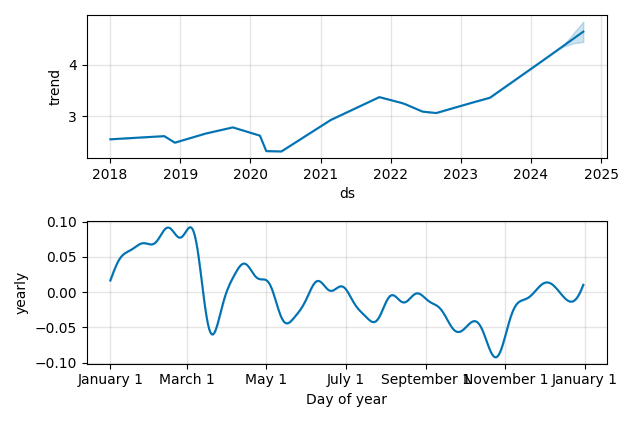

Overall Trend and Yearly Seasonality

VVR Fund Overview

| Market Cap in USD | 647m |

| Style | Bank Loan |

| TER | 2.37% |

| IPO / Inception | 1998-06-24 |

VVR Fund Ratings

| Growth 5y | 7.55 |

| Fundamental | - |

| Dividend | 9.59 |

| Rel. Performance vs Sector | 0.35 |

| Analysts | - |

| Fair Price Momentum | 4.24 USD |

| Fair Price DCF | - |

VVR Dividends

| Yield 12m | 11.64% |

| Yield on Cost 5y | 18.30% |

| Dividends CAGR 5y | 12.12% |

| Payout Consistency | 91.8% |

VVR Growth Ratios

| Growth 12m | 28.93% |

| Growth Correlation 12m | 90% |

| Growth Correlation 3m | 80% |

| CAGR 5y | 9.42% |

| Sharpe Ratio 12m | 1.84 |

| Alpha vs SP500 12m | 11.34 |

| Beta vs SP500 5y weekly | 0.66 |

| ValueRay RSI | 36.50 |

| Volatility GJR Garch 1y | 9.00% |

| Price / SMA 50 | 1.91% |

| Price / SMA 200 | 10.65% |

| Current Volume | 394.5k |

| Average Volume 20d | 651.7k |

External Links for VVR Fund

News

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

Wall Street Journal • Benzinga • Yahoo Finance

Tweets

X (Twitter) • Stocktwits

Fund Manager Positions

Dataroma • Stockcircle

What is the price of VVR stocks?

As of April 27, 2024, the stock is trading at USD 4.26 with a total of 394,500 shares traded.

Over the past week, the price has changed by +0.24%, over one month by +0.31%, over three months by +7.91% and over the past year by +29.97%.

As of April 27, 2024, the stock is trading at USD 4.26 with a total of 394,500 shares traded.

Over the past week, the price has changed by +0.24%, over one month by +0.31%, over three months by +7.91% and over the past year by +29.97%.

What is the forecast for VVR stock price target?

According to ValueRays Forecast Model, VVR Invesco Senior Income Trust will be worth about 4.7 in April 2025. The stock is currently trading at 4.26. This means that the stock has a potential upside of +10.09%.

According to ValueRays Forecast Model, VVR Invesco Senior Income Trust will be worth about 4.7 in April 2025. The stock is currently trading at 4.26. This means that the stock has a potential upside of +10.09%.

| Issuer | Forecast | Upside |

|---|---|---|

| Wallstreet Target Price | - | - |

| Analysts Target Price | - | - |

| ValueRay Target Price | 4.7 | 10.1 |