Schneider Electric: Powering Progress

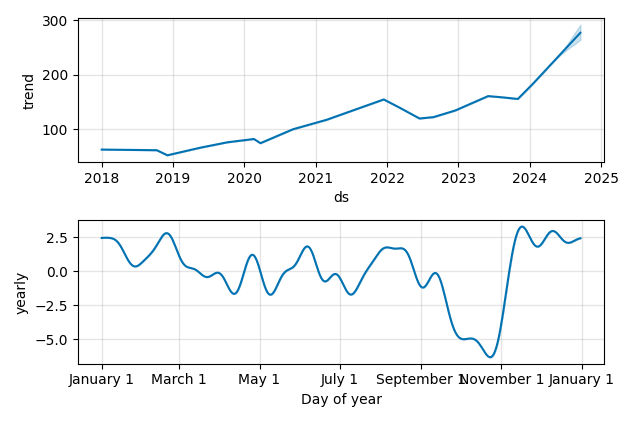

A Rich History of Innovation

Founded in 1836 by the Schneider brothers, Schneider Electric has evolved from a modest iron and steel company to a global leader in energy management and industrial automation. Over the decades, it has expanded its expertise through strategic acquisitions and a focus on innovation, responding to the changing needs of the energy sector.

Core and Side Businesses

At its core, Schneider Electric specializes in the digital transformation of energy management and automation in homes, buildings, data centers, infrastructure, and industries. With the rise of smart grids and renewable energy, the company is at the forefront of developing sustainable solutions that ensure efficiency and sustainability for its customers.

Besides its main operations, Schneider Electric has ventured into software, providing tools and technologies aimed at enhancing operational efficiency for businesses worldwide. This includes energy management software that helps companies monitor and manage their energy consumption more effectively.

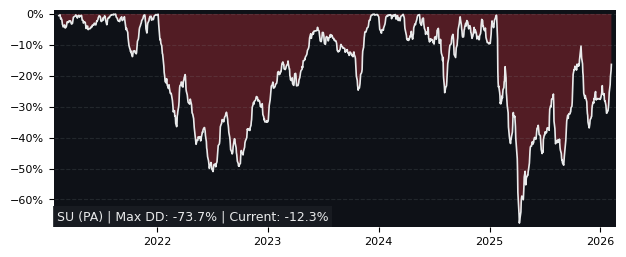

Current Market Status

As of the latest financial reports, Schneider Electric continues to show robust performance in the market. The company has successfully navigated the challenges of the global market, including supply chain disruptions and the push for sustainability, to maintain its position as a leading player in the energy sector. Its commitment to innovation and sustainability has also positioned it well to capitalize on the growing demand for energy-efficient solutions.